We are ushering in a new wave of technology for alternative investment fund managers.

Our software provides fund managers with a single tech platform to manage their business across fundraising, onboarding, reporting and portfolio management.

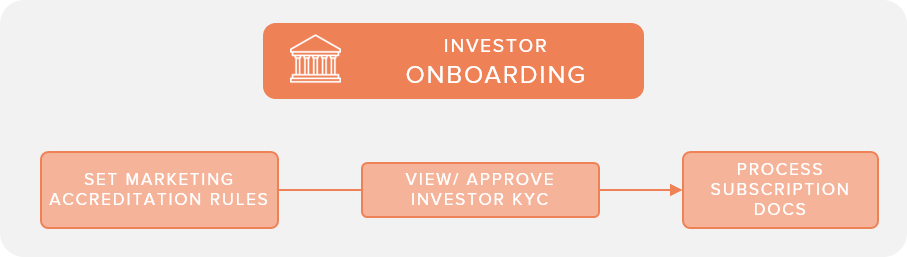

How we simplify Investor Onboarding

As a Fund Manager, our software provides you with tools to streamline your onboarding processes across IR, operations, finance, compliance and 3rd party administrators.

- Customized Investor Accreditation Journeys:

simplify investor onboarding and configure regulatory accreditation journeys based on country, investor type etc. - KYC/AML Workflows: set KYC/AML approval workflows for internal users and allows investors to upload and refresh their AML documents

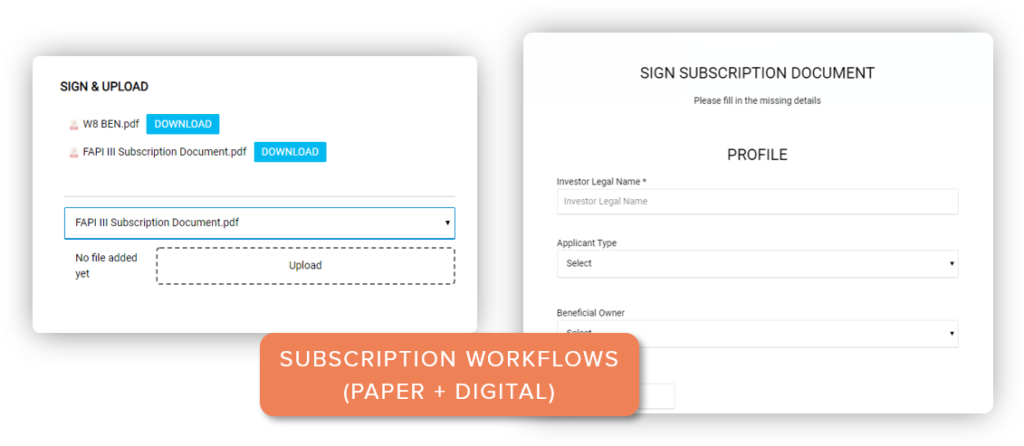

- Subscription Docs Workflows: track subscriptions and permit investors to subscribe manually or digitally

Improve efficiency, controls and compliance across your onboarding process and get full visibility into where each prospective investor sits in the onboarding pipeline.

All this functionality is paired up with a modern, sleek and intuitive Investor Portal to “wow” your current and prospective investors.

Investors can be onboarded through the Investor Portal by following a guided user journey, uploading KYC documents and subscribing into investments.

By using our onboarding tools, Fund Managers can reduce admin & risk, enhance controls & compliance and improve the investor onboarding experience.

Check out our solutions and book a demo if you’d like to see it in action.

ABOUT ATOMINVEST

We are a leading provider of software solutions to the alternative investments industry. Our solutions provide integrated functionality across the full investment lifecycle i.e. deal and relationship management, fundraising & IR, onboarding & ops, reporting and portfolio management, providing firms with a central firm-wide hub for all activity. We provide software to all types of alternative investment managers across private funds (PE, VC, Credit and Real Estate), evergreen funds (hedge, open-ended funds) and direct deals/ co-investments. We are headquartered in London, U.K. and we have deployed solutions globally. For more information come check us out our website.